It’s National Dog Day!

The Demographics of Dog Owners

Today, August 26th is National Dog Day! In honor of our beloved companions, we took a data dive into what sets dog owners apart.

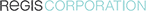

Our politics align with all manner of other things in life, from religion to styles, and what states we live in. And there’s one that causes Republican and Democratic states to come down on different sides: Family pets.

Dog owners vote Re”pup”lican more often

In one glance you can see geographic patterns among dog owners vs cat owners. Southern states which typically vote Republican tend to have higher dog ownership rates, while states which often vote Democrat tend to have more cat owners.

Dog owners tend to have higher incomes

According to CNN.com, owning a dog may help you live longer by reducing risk of cardiovascular disease and death. These benefits were even higher among single people who own dogs.

This may be because taking care of dogs means providing the exercise dogs need.

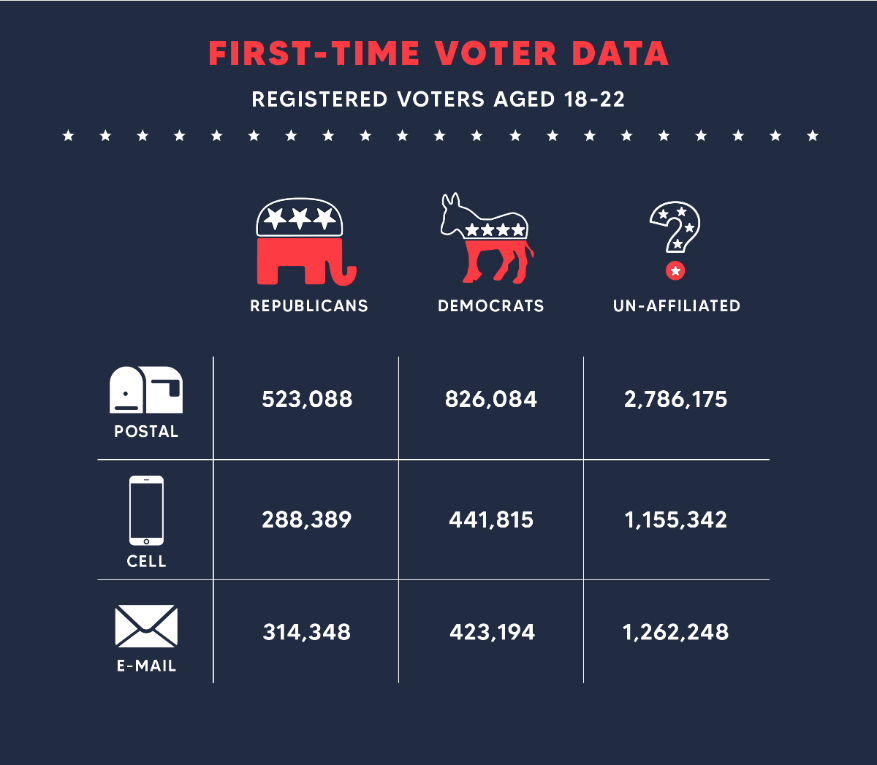

We Have the Data to Fuel Your Campaign!

Total Dog Owners

With Emails : 21,112,325

With Cell : 13,543,916

Republican Dog Owners

With Emails : 1,776,345

With Cell: 1,291,862

Dog Owners who Donate to Animal Charity

With Emails : 5,848,917

With Cell : 3,762,354

Adding dog owners to your prospective lists of political donors and supporters could jump-start your fund-raising efforts. Dog owners tend to donate to animal welfare groups and engage in other forms of charitable giving.

Lists of dog owners start at just 3 cents per record with an Email or Cell number.

Don’t forget about our other data and services below!

Phone Append ($.03/match)

Add missing cell or landline

numbers to your mailing lists

Email Append ($.03/match)

Add missing E-mails

numbers to your mailing lists

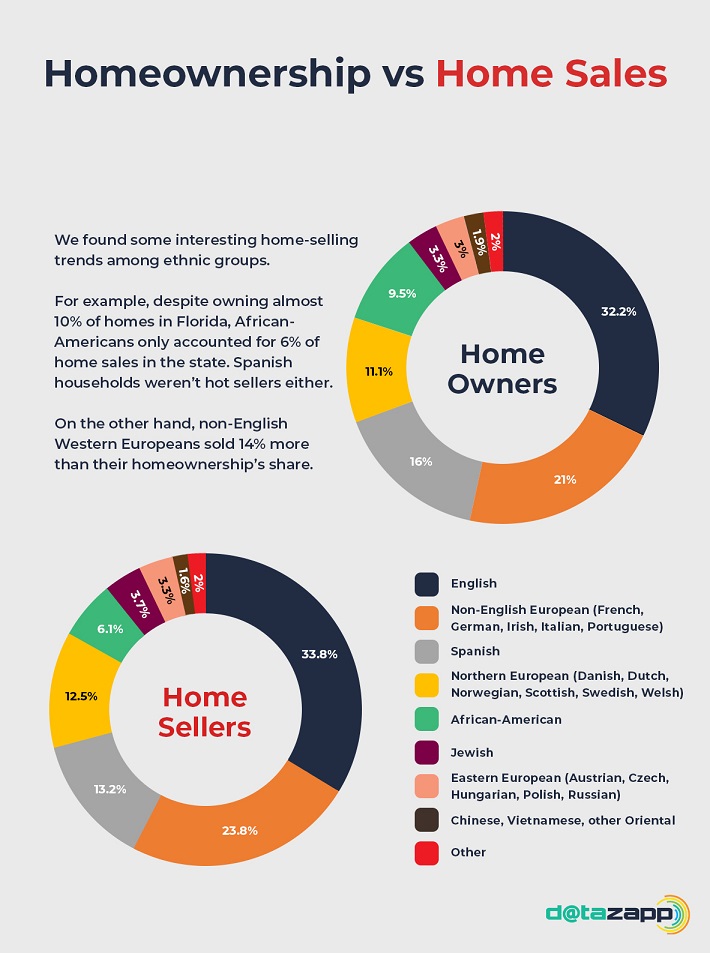

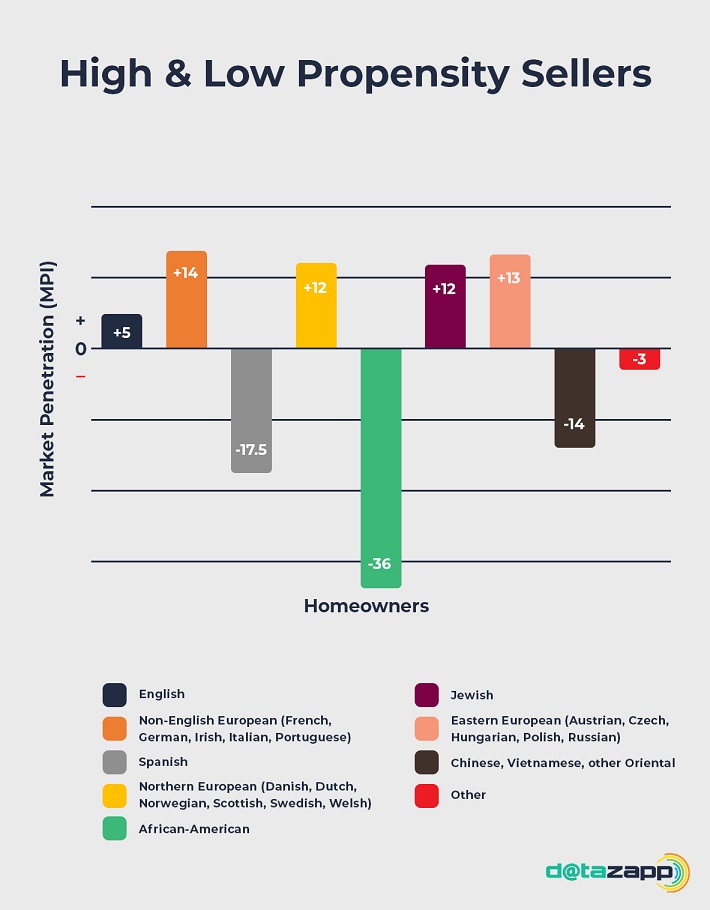

Properties & Motivated Sellers

Create Home & Property Owner

Lists with Phone or E-mail

Voters & Political Donors

Create Targeted Voter

Lists with Phone or E-mail